EIN Employer Identification Number The EIN or Employer Identification Number is also known as a federal Tax Identification Number TIN and is used to identify a business or nonprofit entity. One of the earliest taxes mentioned in the Bible of a half-shekel per annum from each adult Jew Ex.

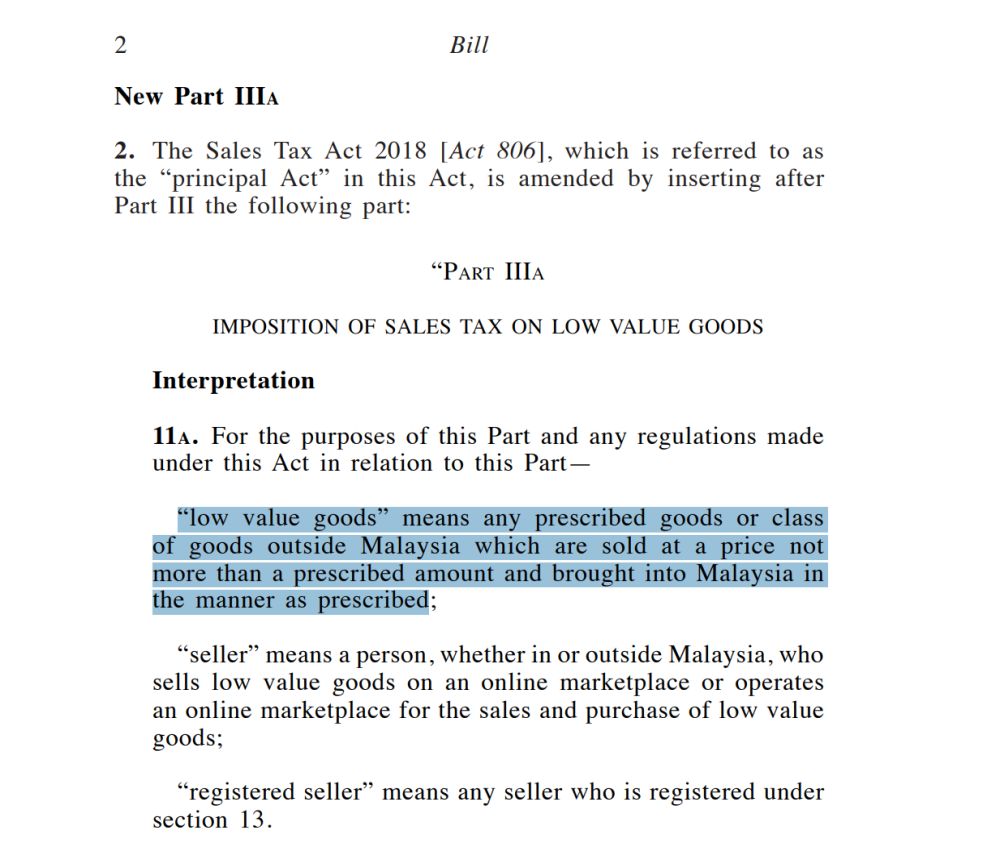

Online Shopping Tax Malaysia Is A Step Closer To Impose 10 Tax On Imported Goods Worth Under Rm500 Soyacincau

Poll taxes are administratively cheap because.

. Working hours permitted under Akta Kerja 1955. Relevant Provisions of the Law 21 This PR takes into account laws which are in force as at the date this PR is published. As of May 11 2011 1 Africa.

In fact 90 percent of our tax law program graduates find full-time long-term tax-related positions within nine months of graduation. A worker cannnot work for directly for 5 hours non stop without a minimum rest time for 30 minutes. Therefore gains made by occasional trading in cryptocurrencies should be viewed as capital gains and under the local tax law capital gains are not taxed.

Petersburg Florida USA 33701. Each edition rates the tax expertise offered in various jurisdictions giving tax executives the most comprehensive information about the market for tax advice. Suite 300 - 1055 West Hastings St.

Self parents and spouse 1. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020. Tax-exempt organizations whose annual gross receipts are normally less than 50000 are eligible to file instead of Form 990 or Form 990-EZ.

Brad Littles tax cuts and education funding bill sailed relatively smoothly through a. The sedition law prescribes a maximum fine of RM5000 or a jail sentence of three years for a convicted first-time offender or both and raises the jail term to five years for subsequent offenses. SORN stands for Statutory Off Road Notification.

This article kickstarts the series of the Top 5 cases for the year 2020. With that said the Malaysian tax authorities have recently updated its Guideline on Taxation of Electronic Commerce Transactions in 2019 to include digital currency under its scope of charge. 122019 Date of Publication.

Income tax law means the law in force in Malaysia regulating income tax. Relevant Provisions of the Law 1. SG 12345678901 Tax Reference.

360 Central Avenue Suite 310 St. A worker cannot work more than 8 hours per day and more than 48 hours per week. The most common tax reference types are SG OG D and C.

A poll tax also called a per capita tax or capitation tax is a tax that levies a set amount per individual. INLAND REVENUE BOARD OF MALAYSIA TAX TREATMENT OF FOREIGN EXCHANGE GAINS AND LOSSES Public Ruling No. BOISE Though some tempers flared and the governor made a last-minute change in the bill Gov.

Under any law to be in a state of unsoundness of mind however described. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. What are the statutory deductions from an employees salary.

Vancouver BC Canada V6E 2E9. When tax performance is put under a microscope you need precise knowledge forward-thinking perspectives and a steady trusted hand. Tax rebate for Self.

Income tax includes any tax of a substantially similar character by whatever name called imposed in Malaysia. Lembaga Hasil Dalam Negeri Malaysia classifies each tax number by tax type. Inland Revenue Board of Malaysia means the Inland Revenue.

World Tax is unique among directories as it classifies professional services law firms and other tax advice providers together rather than looking at them separately because they. This follows last years Top 5 Company Law Cases in Malaysia for 2019 restructuring and insolvency cases and arbitration casesThis years series will cover five areas. 301116 was a form of the poll tax.

2010 Malaysia-UK Protocol - in force. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. The law states that a registered vehicle being kept or used on public roads must be both taxed and insured.

Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. The 2010 protocol entered into force on 28 December 2010 and is effective in both countries for tax years from 1 January 2011. With that heres LHDNs full list of tax reliefs for YA 2021.

The Inland Revenue Board of Malaysia Malay. Loyola Law Schools Tax LLM graduates are highly coveted by law firms the Big 4 the IRS and other tax authorities throughout the United States. You dont need to tax your car if youre not driving or parking it on a public highway.

Your Income Tax Number consists of a tax reference type of 1 or 2-letter code followed by a 10 or 11-digit tax reference number. It is an example of the concept of fixed tax. Malaysias basic labour law for Employers.

Claiming these incentives can help you lower your tax rate and pay less in overall taxes. Passionate collaborative and committed to your business success KPMGs Tax practice in Malaysia works with you to learn all we can about your organization understand your goals and uncover unexpected. Corporation Tax from 1 April 2020 Income Tax and Capital Gains Tax from 6 April 2020 in India for taxes withheld at source on amounts paid or credited to non-residents from 1 April 2020.

If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. This tax rebate is why most Malaysia n fresh. You will be granted a rebate of RM400.

If its kept off road in a garage on a drive or on private land it must be declared SORN. 13 December 2019 CONTENTS Page 1. Countries with and without Income Tax Treaties with the US.

Company law tax construction restructuring and insolvency and arbitration cases in Malaysia. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021. Malaysia follows a progressive tax rate from 0 to 28.

Taxpayer retires at the age of 55 or at the compulsory age of retirement under any written law. Youre eligible for an automatic tax deduction of RM9000 just by filling in the LHDN e-Filing form. The deadline for filing your income tax returns form in Malaysia varies according to what type of form you are filing.

In Malaysia there is a rebate in income tax for money paid to the government in form of zakat or the obligatory alms Muslims must give to.

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Tax Clearance For Expats In Malaysia

Expat Friendly Taxes In Malaysia International Living Countries

Malaysia Payroll And Tax Activpayroll

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

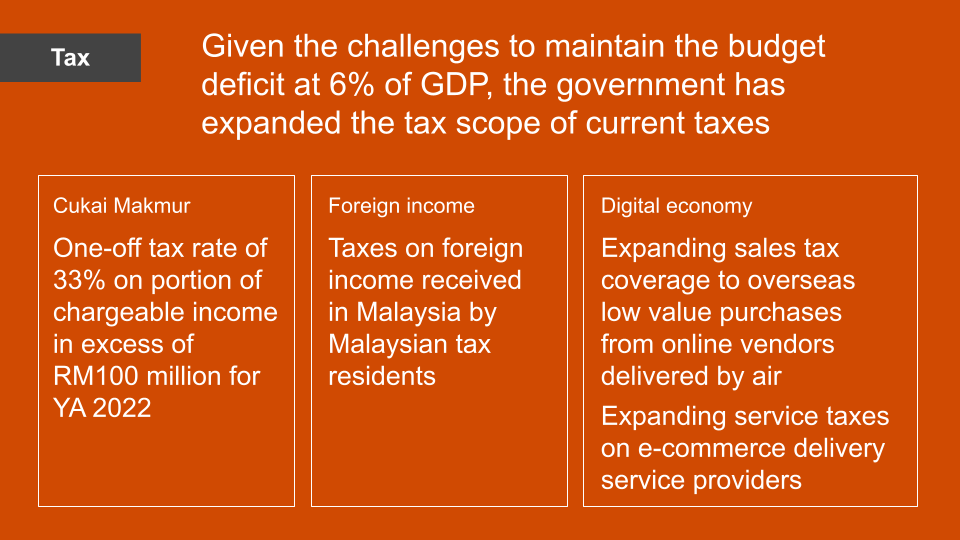

Malaysia Sst Sales And Service Tax A Complete Guide

Tax Clearance For Expats In Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

6 Important Company Taxes In Malaysia With Tax Rates Of 2021 Foundingbird

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

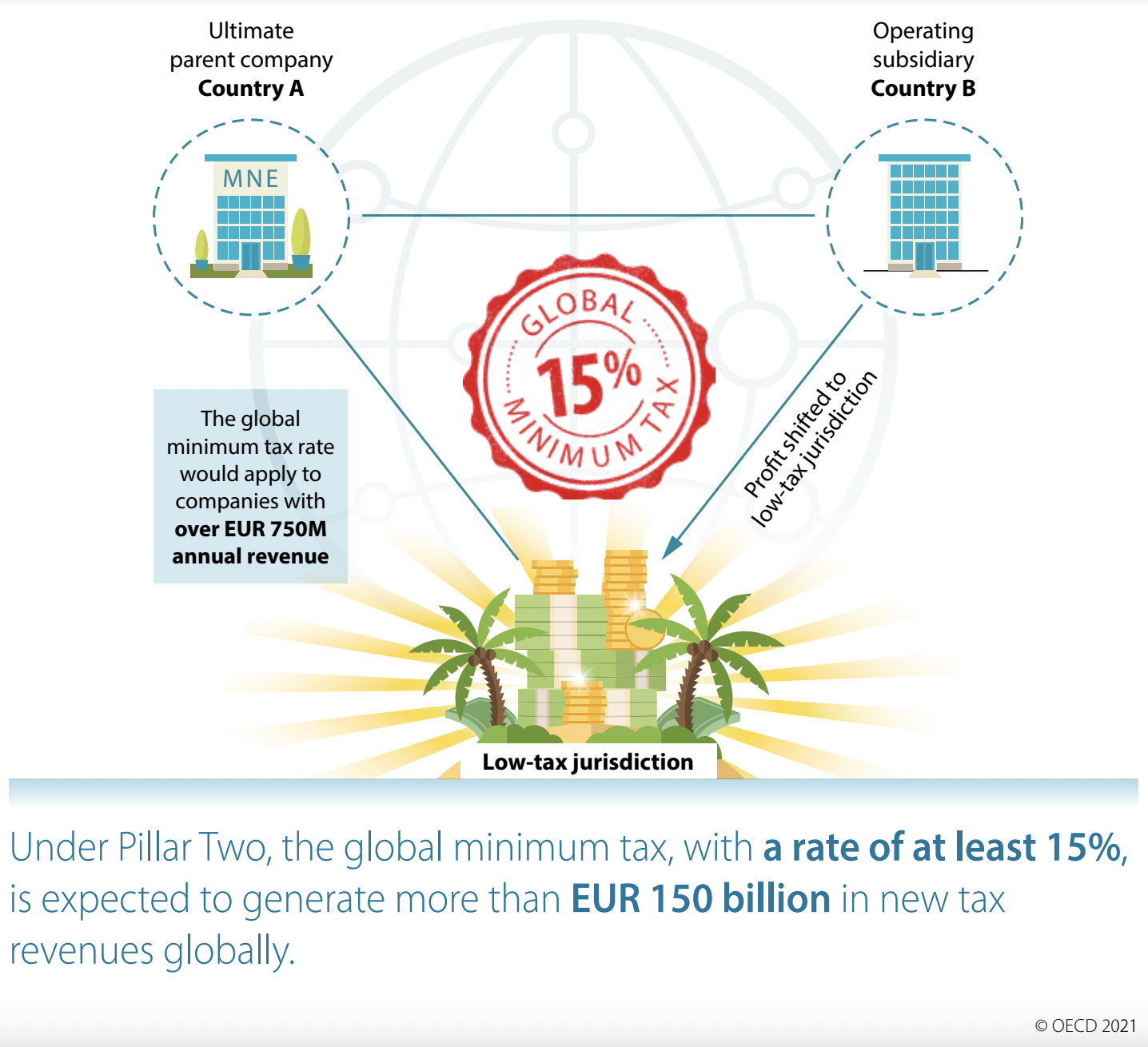

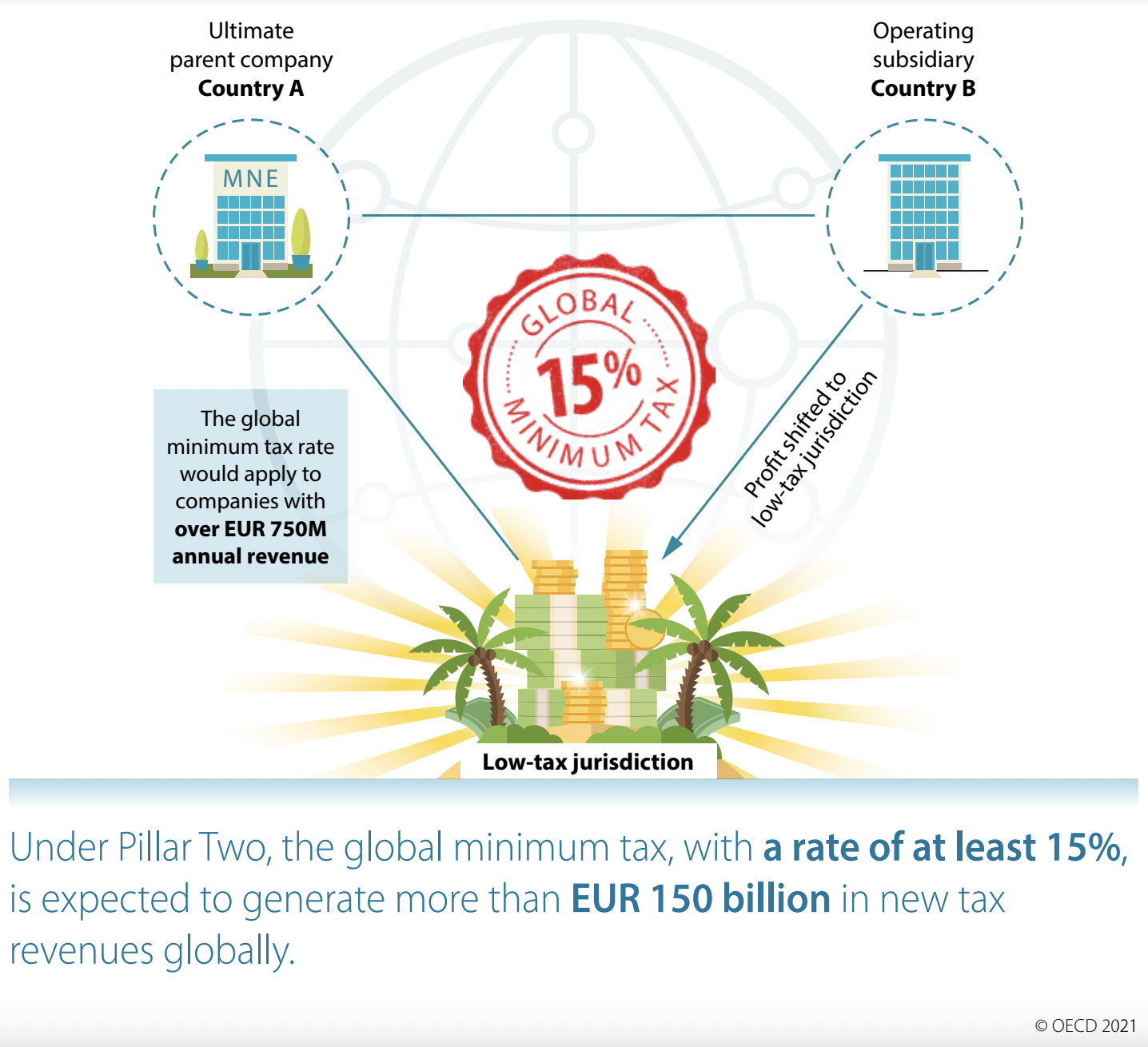

Digital Taxation In 2022 Digital Watch Observatory

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

Foreign Income Tax Malaysia Removal Of Exemptions